Creating Sustainable Sensory Experiences

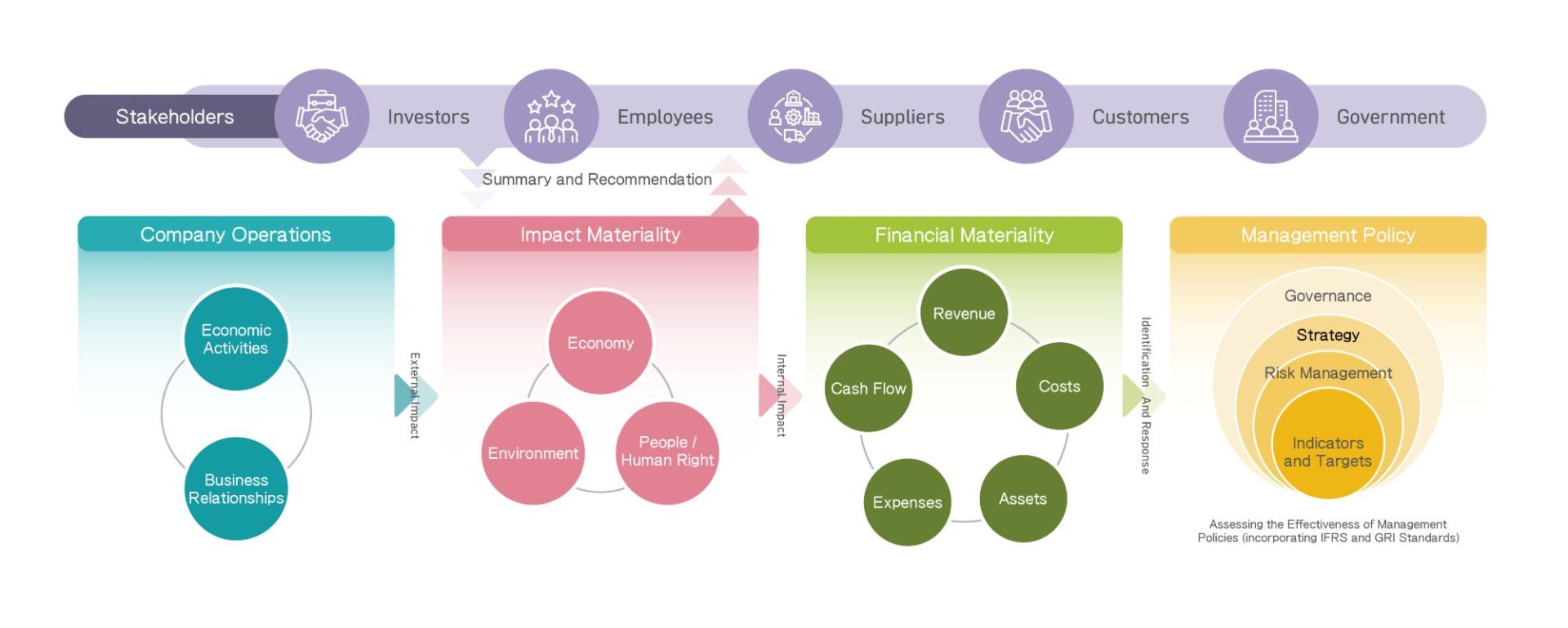

An annual sustainability materiality analysis and identification process is conducted. In 2024, the ''Double Materiality'' analysis principle continues to be adopted, based on ''GRI 3: Material Topics 2021'', while also referencing IFRS and ESRS guidelines regarding sustainability impacts. Sustainability impacts are incorporated into both Impact Materiality and Financial Materiality. A five-stage identification process is implemented to assess the effects of MERRY’s business activities on various sustainability dimensions, including impacts on society, the environment, people, and human rights (external impacts), as well as the financial impacts (internal impacts) arising from resource allocation to manage these impacts. By weighing both external and internal impacts, the results of the sustainability impact analysis are produced, which determine the priority material sustainability topics for reporting. Relevant sustainability issues are identified by comprehensively considering operational activities, business relationships, and stakeholder profiles, as well as sustainability reporting standards (GRI, SASB), international sustainability assessment indices (MSCI, S&P CSA, CDP), and benchmarking corporate practices. The Sustainable Development and Nomination Committee, the Sustainable Development Promotion Team, and relevant core executives (director level and above) analyze the quantitative impact—actual or potential, positive or negative—of each issue on the economy, environment, and people and human rights within the company’s operations and business relationships. Through further discussion, the significance of each issue is prioritized, material sustainability topics are confirmed, and the disclosure of their targets, plans, and management performance is prioritized. The 2024 materiality results, together with senior management’s sustainability objectives, are submitted to the Board of Directors for approval following endorsement by the CEO.

| 說明 | ||

|---|---|---|

| 1 | Understand organizational context | Identify the concerns and potential impacts of five categories of key stakeholders; analyze the possible impacts arising from economic activities and upstream and downstream business relationships within the value chain during operations; and, following comprehensive synthesis, develop a list of 19 sustainability issues. |

| 2 |

Identification of External Impacts-Impact materiality |

By continuously integrating stakeholder engagement information and conducting materiality identification workshops, supervisors at the director level or above from departments responsible for each issue carry out impact identification. A quantitative analysis is conducted to assess the actual or potential, positive or negative severity of 19 sustainability issues. Based on the current management intensity, the organization prioritizes external impact materiality—including value chain, environmental, and social dimensions.

Impact materiality identification method Impact materiality of negative impacts:Severity(scale、scope、remediability) X Likelihood Positive impact materiality:Severity(scale、scope)X Likelihood |

| 3 | Identification of Internal Impacts-Financial materiality |

Based on the impact materiality of 19 sustainability issues, supervisors at the manager level and above in the Finance Department further discuss the opportunities or risks that external impacts may pose to internal operational activities, as well as the direct or indirect short-, medium-, and long-term financial impacts. The degree of impact is assessed with reference to financial statement materiality standards. The correlation between various financial indicators and the value of MERRY Electronics is analyzed, using the 2023 net profit after tax as the benchmark for measuring the degree of financial materiality. Financial impacts include information related to financial statements, such as revenue, costs, expenses, cash flows, and financing/fundraising.

Financial Materiality Identification Method Financial materiality:Operational impact magnitude X Likelihood |

| 4 | Management Guidelines Proposal | Aggregate the identification results of impact materiality and financial materiality for each issue, and rank both impact materiality and financial materiality separately according to positive and negative impacts. Subsequently, collaborate with the strategic planning department, based on future operational plans, to ensure that these material topics are aligned with MERRY’ business risks and strategies, thereby confirming the final materiality assessment results. The responsible departments shall, based on the assessment results, formulate policies, implementation plans, and set targets for each issue. |

| 5 | Determination of Material Sustainability Issues | Based on the confirmed material topics for disclosure, and aligned with the 14 GRI topics as well as the SASB Technology and Communications sector—specifically the Hardware industry—disclosure topics and indicators are developed. These are identified through discussions with relevant departments and are subject to final approval by the CEO. |

| 6 | Integration into Governance and Accountability | On December 26, 2024, a proposal was submitted to the Board of Directors for discussion, confirming 11 material topics to be disclosed in the sustainability report. In conjunction, the sustainability objectives linked to senior supervisors’ compensation were also approved. |

Identification of Priority Material Topics

Based on the results of the sustainability impact analysis and the double materiality assessment approach, eight negative and eight positive material topics were identified, resulting in a total of eleven material issues. In addition, two secondary topics were designated as issues for ongoing monitoring.

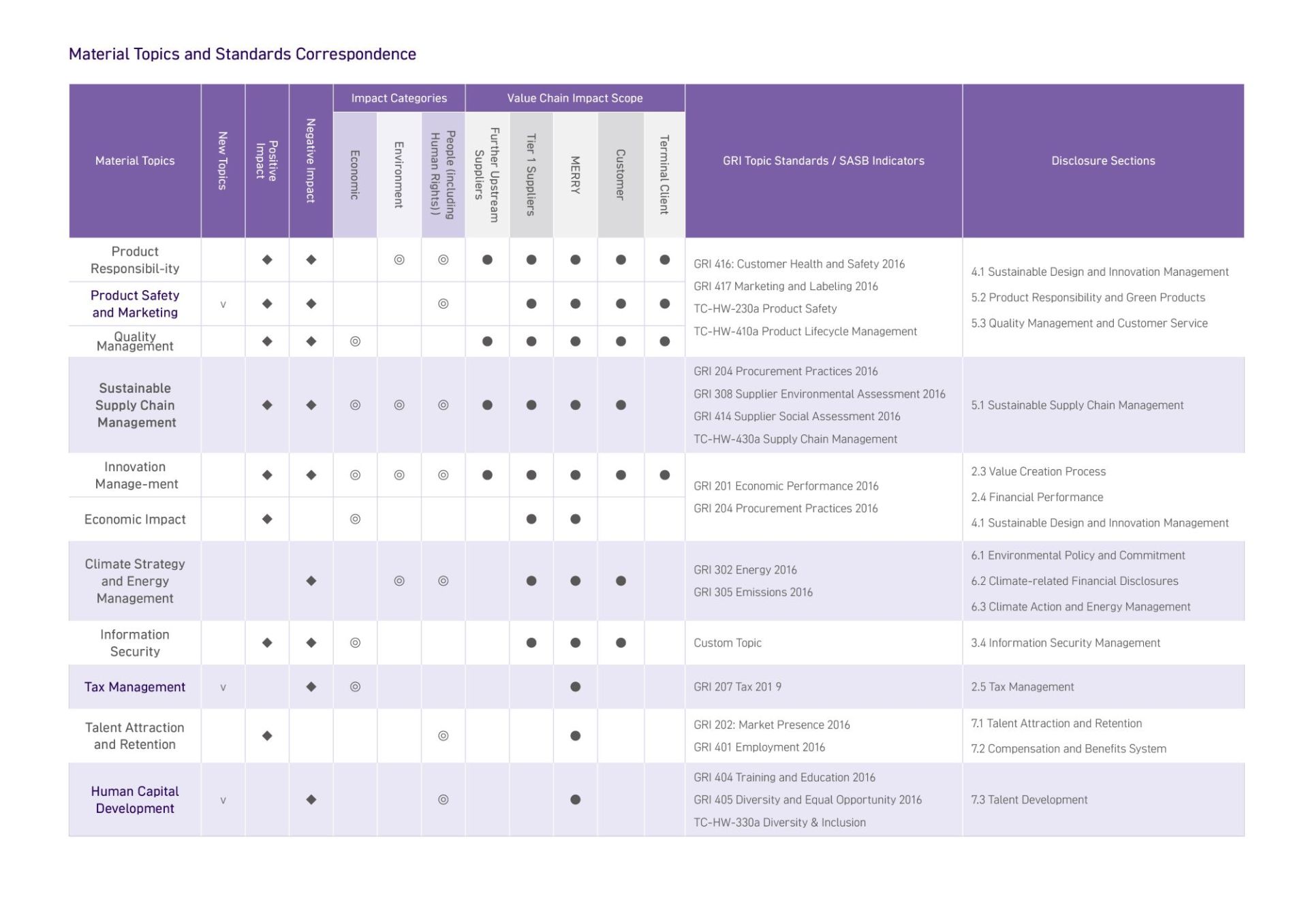

Material Topics and Standards Correspondence