- The Audit Committee was established in 2019.

- Composed of 3 Independent Directors (She, Ri-Hsin, Wu, Hui-Huang, and Yi, Chang-Yun), with independent director She, Ri-Hsin serving as the Convener.

- A total of 6 meetings were held in 2024, with an attendance rate of 100%. For detailed execution status, please refer to the annual report or the Corporate Website.

Empowerment and Accountability

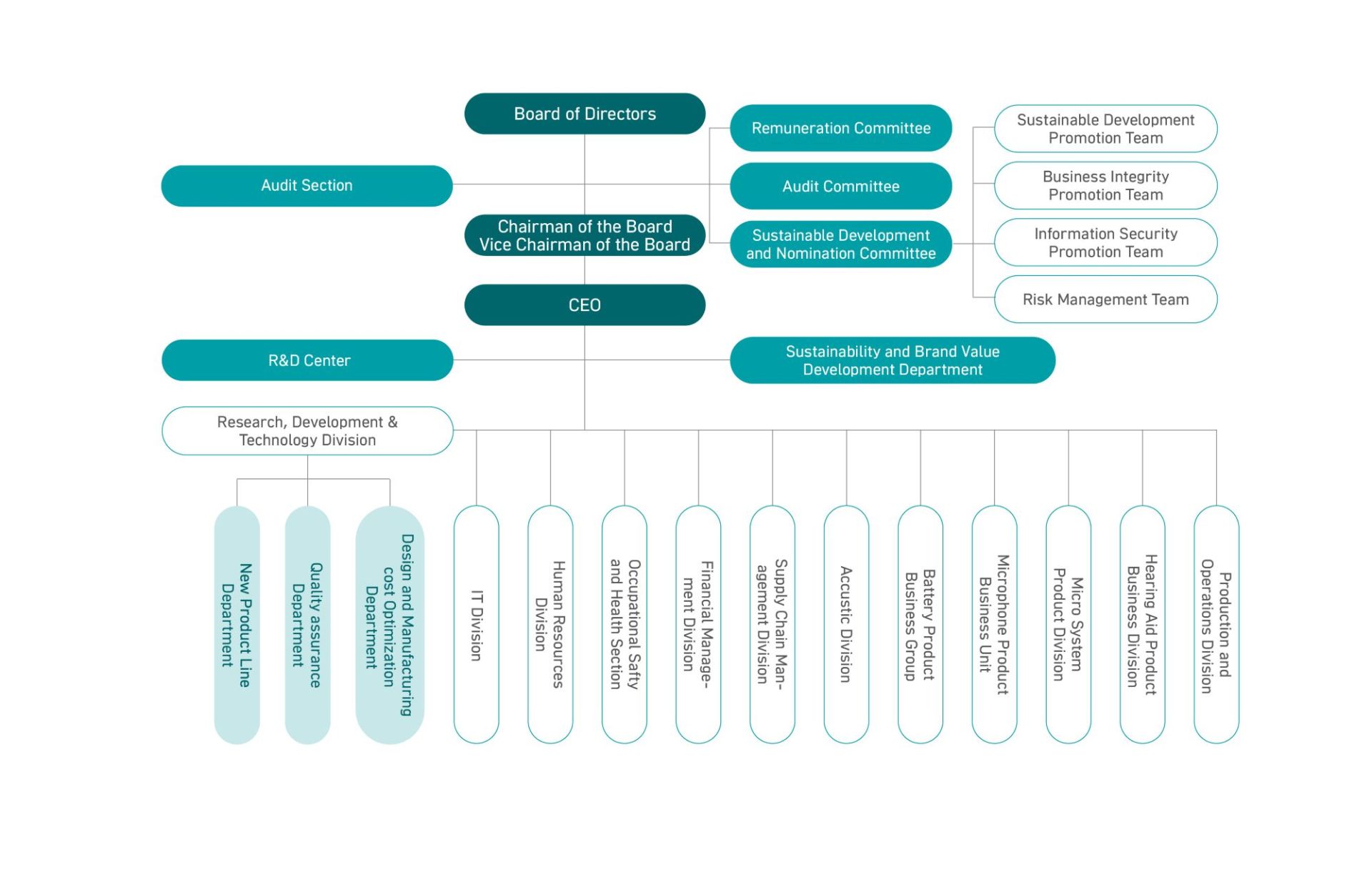

In alignment with the company's operational management, three Functional Committees are established under the Board of Directors and report to the Board.

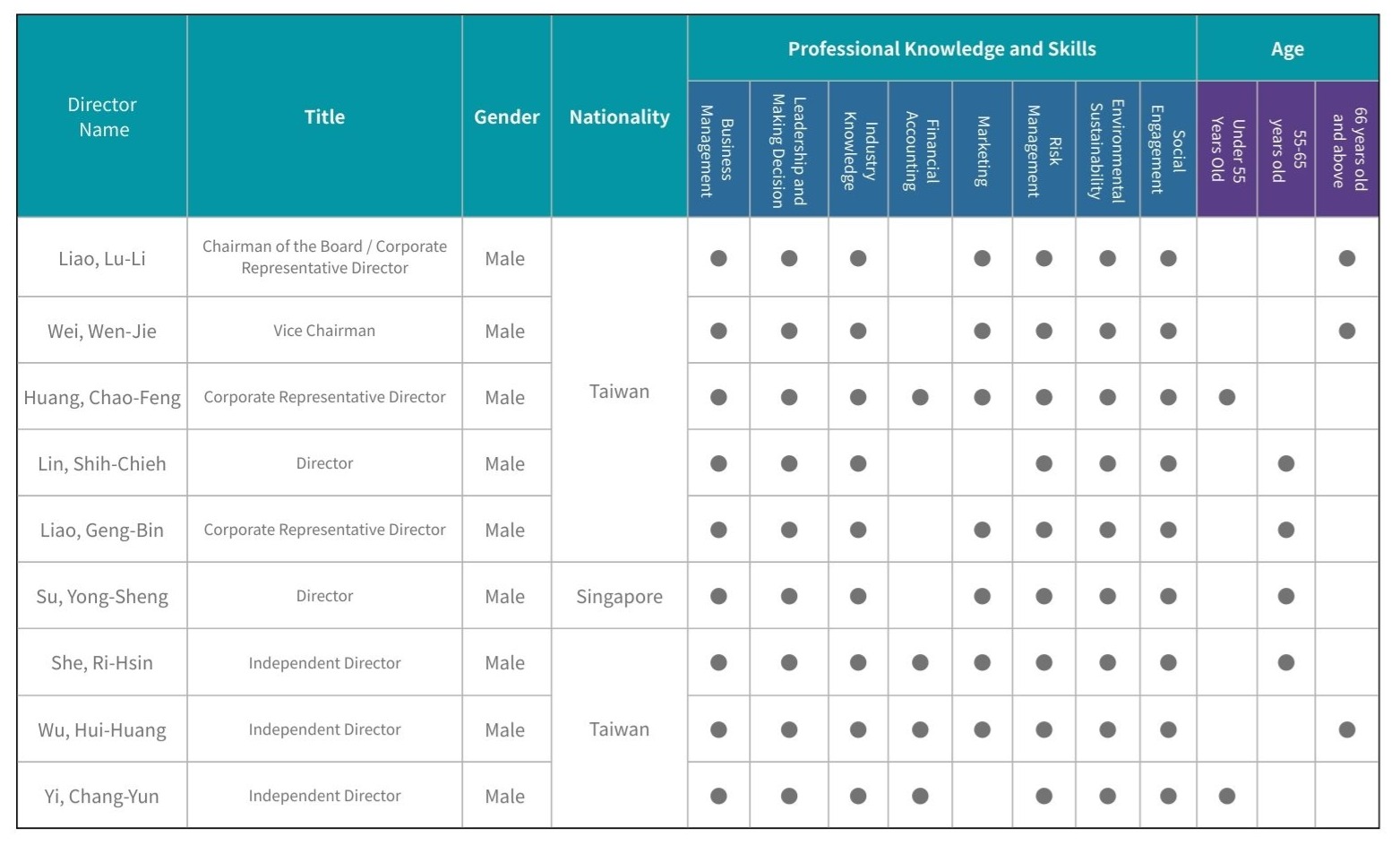

MERRY's highest governance body is the Board of Directors. The current Board comprises nine members: six Directors and three Independent Directors. All are distinguished professionals with extensive industry experience, elected by the annual general meeting of shareholders on June 15, 2022, for a term of three years. The Board of Directors operates in compliance with the "Board Meeting Rules of Procedure", holding meetings at least once per quarter. In 2024, a total of 6 Board of Directors meetings were convened. All Board of Directors members uphold a high degree of self-discipline; should a proposal involve individual interests, they shall recuse themselves from voting in accordance with the conflict of interest avoidance system stipulated in Merry's "Board Meeting Rules of Procedure". Directors participate in an average of 8.3 hours of training related to "Corporate Governance"and corporate sustainable "Governance", and continuously enhance their professional knowledge through diversified courses to fully exercise their management decision-making and oversight functions. Further details regarding the operation of the Board of Directors, including board meeting minutes, attendance records, recusal from interested party resolutions, and continuing education status, along with information pertaining to cross-shareholdings of interested parties, the existence of controlling shareholders, and related party transactions, as well as disclosures concerning members' background information, educational qualifications, concur[1]rent positions held in other companies, the independence of Independent Directors, and the operational status of each Functional Committee, are all published in the Company's Annual Report or on the Corporate Website. The Annual Report and relevant information can be accessed via the Market Observation Post System and the Corporate Website.

To effectively enable the Board of Directors to exercise impact management over Sustainability Issues and to enhance its decision-making quality, company regulations explicitly stipulate that for critical sustainability-related events or significant topics identified during operations, reports on relevant matters must be submitted to the Board of Directors periodically or on an ad-hoc basis. In accordance with relevant laws and internal procedures, various proposals are submitted to the Board of Directors as "Agenda Item" or "Reporting Item". Related proposals, approved by senior management on a "Board of Directors Proposal Form", are then included in the agenda of the next Board of Directors meeting by the stock affairs unit. The Board of Directors will subsequently make resolutions on "Agenda Item" and provide feedback or suggestions on "Reporting Item". Since 2022, the Greenhouse Gas Inventory has been a regularly reported item to the Board of Directors, and climate-related financial disclosures (TCFD) have been incorporated into risk management reports and simultaneously submitted to the Board of Directors. In 2023, the Sustainable Development and Nomination Committee was established. In 2024, the results of the sustainability report compilation will be submitted to the Board of Directors for discussion and issued following a resolution, thereby strengthening corporate Sustainable Development Governance and internal control mechanisms. In 2024, the Board of Directors addressed 13 Reporting Items and 18 Agenda Items related to key sustainability events, which included 8 Environment-related items, 18 Governance-related items, 3 Social-related items, and 2 items encompassing the aforementioned three aspects. All material resolutions of Merry's Board of Directors in 2024 have been published on the Corporate Website.

Functional Committee

Audit Committee 【Responsibilities】 【Operation】 Remuneration Committee 【Responsibilities 】 【Operation】 Sustainable Development and Nomination Committee 【Responsibilities】 【Operation】

operational mechanisms.

Linking Compensation with Sustainability Performance

To incentivize senior executives to prioritize long-term comprehensive performance and achieve sustainable operations, effective from 2023, in addition to considering their scope of work, responsibilities, and business unit operational performance, the goals and weights of sustainability indicators will also be incorporated into the compensation allocation for senior Executives and product business group heads. Each sustainability indicator will be further cascaded down to responsible departments and included as performance assessment indicators for department heads, establishing management guidelines for each Sustainability Issue (annual action plans, tracking mechanisms, stakeholder engagement), along with regular tracking of the execution results of these indicators.

| Senior Executive | Sustainability Metric Item | Weighting Percentage |

|---|---|---|

| CEO | Climate Strategy | 10% |

| Talent Attraction and Retention | ||

| CTO | Climate Strategy | 5% |

| CHRO | Talent Attraction and Retention | 5% |

| CPO | Supply Chain Environmental Management | 5% |

| Product Business Group Head | Sustainable Products | 5% |

| CISO | Information Security | 5% |

| CFO |

Integrity Management |

5% |