Climate-related Financial Disclosures(TCFD)

MERRY's governance level comprehends the potential impacts of climate change on operations and long-term development. Since 2020, it has implemented climate change-related management mechanisms, progressively expanding the scope of climate-related risk and opportunity assessments each year.

Climate Governance

| Board Oversight |

The Board of Directors is MERRY's highest decision-making authority for climate change risk management. It is responsible for approving relevant risk management policies, monitoring the implementation of climate-related risk management, guiding decision-making on response strategies, supervising the execution of these strategies, and evaluating the achievement of objectives. |

| Management responsibilities |

Sustainable Development and Nomination Committee:

- Chaired by Independent Director Wu Huihuang as convener, with President Huang Chaofeng concurrently serving as Chief Sustainability Officer, the committee convenes regularly to conduct sustainability development planning, implementation, and performance review.

- It also functions as the supervisory body for the assessment and execution of climate change risk and opportunity management.

Risk Management Team:

- Led by the department specialized in risk management, a cross-departmental working group has been established to identify climate change risks and implement response plans, coordinating the planning of risk and opportunity identification and response plan development within the risk management process; The climate change risk assessment operations are integrated with existing risk management processes through the ISO 31000 management system framework, with risk management activities conducted annually. The Risk Management Team regularly reviews execution outcomes, consolidates climate change risk management reports, and reports at least annually to the Board of Directors on the assessment results of climate change risks and opportunities, providing guidance on the management and implementation of climate risks and opportunities.

- From 2024 to the first quarter of 2025, the Risk Management Team convened meetings for MECL to assess climate change risks and opportunities and developed response plans for key risks. The results are incorporated into the operational promotion plans of relevant units and are regularly reported to the Sustainability Promotion Committee and the Board of Directors as references for governance decision-making.

Climate Change Task Force:

Composed of cross-departmental supervisors, responsible for advancing the management of climate change risks and opportunities, convening colleagues from relevant units to assess risks and opportunities, and planning response measures.

Functional/Business Units:

Regularly conduct assessments and analyses of climate change risks and opportunities, plan and implement response measures, and periodically report on execution outcomes and performance.

|

Climate Scenario

MERRY is not an industry with high carbon emission intensity; however, global warming and the resulting climate change affect our key stakeholders. To promptly respond to market trends and potential customer demands, climate change risks and opportunities are identified through scenario analysis. The assessment results are thoroughly reviewed by business units and functional departments to serve as reference guidelines for daily operational adjustments. Additionally, regular progress and outcome reports are submitted to the Sustainability Development and Nomination Committee and the Board of Directors, serving as reference factors for group operational decision-making. In light of these considerations, the SSP5-8.5 scenario was selected for assessing physical risks, while the national target scenario and the IEA Net Zero Emissions by 2050 Scenario—aligned with SBTi decarbonization pathways—were adopted for evaluating transition risks. External factors such as policy changes, physical environment, societal trends, and technological developments were also reviewed as the basis for the annual climate change risk assessment.

Risk Management

In accordance with the climate change risk management process, climate-related risks and opportunities are identified, response strategies are evaluated, and internal and external reports are regularly prepared. Climate-related risk factors have been integrated into the existing risk management mechanism and are regularly advanced by the Risk Management Team.

| Risk Inventory |

Identify risk and opportunity items relevant to MERRY based on domestic and international regulations and external stakeholder expectations, and include them in the assessment list. |

| Key Risk Analysis |

Implementation method: Invite relevant departments to conduct evaluation and discussion; the Risk Management Team assesses, analyzes, and confirms the results.

Assessment dimensions:Risk occurrence timeframe (short term 1-3 years, medium term 5-10 years, long term more than 10 years), risk likelihood, risk occurrence location (direct operations, upstream supply chain, downstream customers), risk impact severity.

Assessment Items:Transition Risks policy and regulation, technology, market, reputation) and Physical Risks (Immediate and Long-term)

The analysis results are quantitatively ranked, with the top three risks and opportunities identified as key risks. |

| Financial Impact Assessment of Risks and Opportunities |

Taking into account the likelihood of risk or opportunity occurrence and the degree of operational impact, assess the potential financial impact items and their extent. |

| Response Planning and Reporting |

For key risks and opportunities, considering the extent of financial impact, assess response strategies (mitigation, transfer, acceptance, control) and develop corresponding action plans. Reporting is conducted in accordance with internal management procedures and disclosed regularly in the sustainability report. |

Indicators and Targets

MERRY commits to achieving group-wide carbon neutrality by 2040, in response to international trends and the national 2050 net-zero target, identifying climate change risks and opportunities, integrating existing sustainability objectives, and establishing related indicators and targets.

| |

Indicator |

2024 Target and Achievement |

2025 Target |

2030 Target |

| Governance |

Group Risk Management and Continuous Operation Plan |

- Enhance Risk Management Mechanism, Strengthen Climate Governance and Governance Level Engagement

- Climate Risk Assessment Extended to MECL

|

- Promotion of relevant systems at china operating sites

|

- Promote relevant systems in all operating locations

|

| Strategy |

Revenue from Sustainable Design Products |

- Environmental Material Usage Ratio of Over-ear Headphone Structural Components Reaches 31.18%.

- The proportion of environmental materials used in packaging for over-ear and true wireless headphones is 50.2%.

- The proportion of designated development projects implementing optimized PCB cases is 30%.

- Product charging efficiency increased by 12%.

|

- The proportion of environmental materials used in structural components of over-ear headphones reaches 40%.

- The proportion of environmental materials used in packaging for over-ear and true wireless headphones reaches 45%.

- The proportion of designated development projects implementing optimized PCB size cases is 30% (total PCB volume reduced by 1%).

- Product power consumption optimization:HDT – power saving proportion per development project ≥ 2.5%;TWS – product power consumption optimization proportion ≥ 4%.

- Carbon emission estimation during raw material stage

- Penetration rate of sustainable material product lines: HDT 40% / TWS 5% / VC 5% /SPK 5%

|

- Use of environmental materials in overear headphone mechanical components accounts for 55%

- Headphone packaging utilizes entirely paper or recycled materials, with all paper materials FSC certified

- 25% of designated development projects have implemented optimized PCB sizes (total PCB volume reduced by 2.5%)

- Product power consumption optimization: HDT – power saving per development project ≥ 2.8%;TWS – product power consumption optimization rate ≥ 4.3%

- Establish a comprehensive environmental database for all products to calculate product carbon footprints.

|

| Risk Management |

Renewable Energy Usage Ratio (RE100) |

- Commitment to achieve the RE100 target by 2030 ahead of schedule.

- Used 13,994 MWh of renewable energy, accounting for 43.11% of total electricity consumption.

|

- The group uses 60% renewable energy.

|

- The group uses 100% renewable energy.

|

| Risk Management |

Carbon Emission Intensity and Energy Intensity (Base Year 2020) |

- Scope 1 emissions reduced by 51.34% compared to 2023; Greenhouse gas emissions intensity for Scope 1 & 2 were representing a 15.44% reduction compared to the previous year.Energy intensity decreased by 19.34% compared to 2023.

- Implementation of a greenhouse gas inventory system

|

- Adhering to science-based reduction targets.

- According to SBTi, an 8.4% carbon reduction in Scope 1 and Scope 2, with strategic planning

- Energy management: a 2% reduction relative to the baseline year 2023.

- Implementation plan for the Group’s 2040 carbon neutrality target.

|

- Adhering to science-based reduction targets.

- Implementation plan for the Group’s 2040 carbon neutrality target.

|

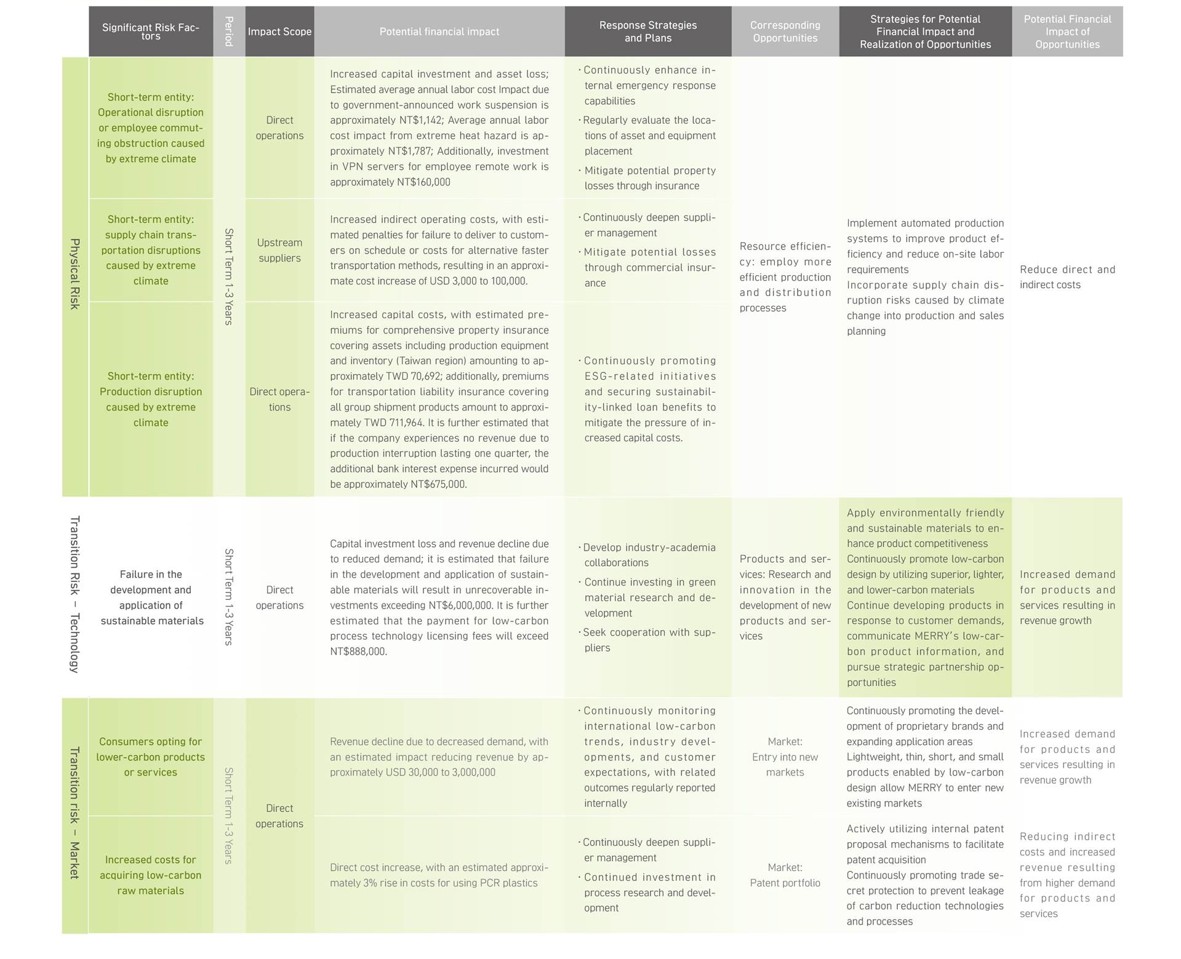

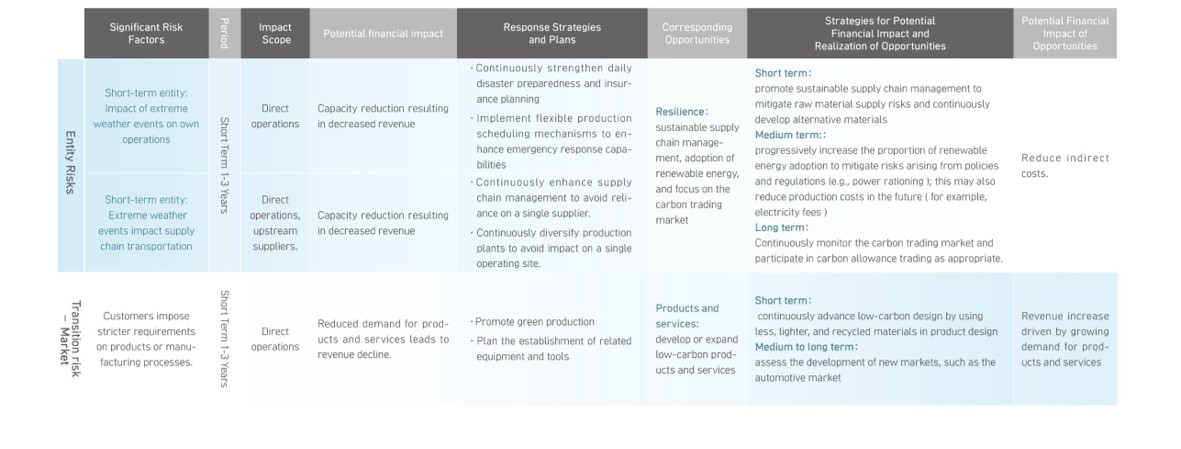

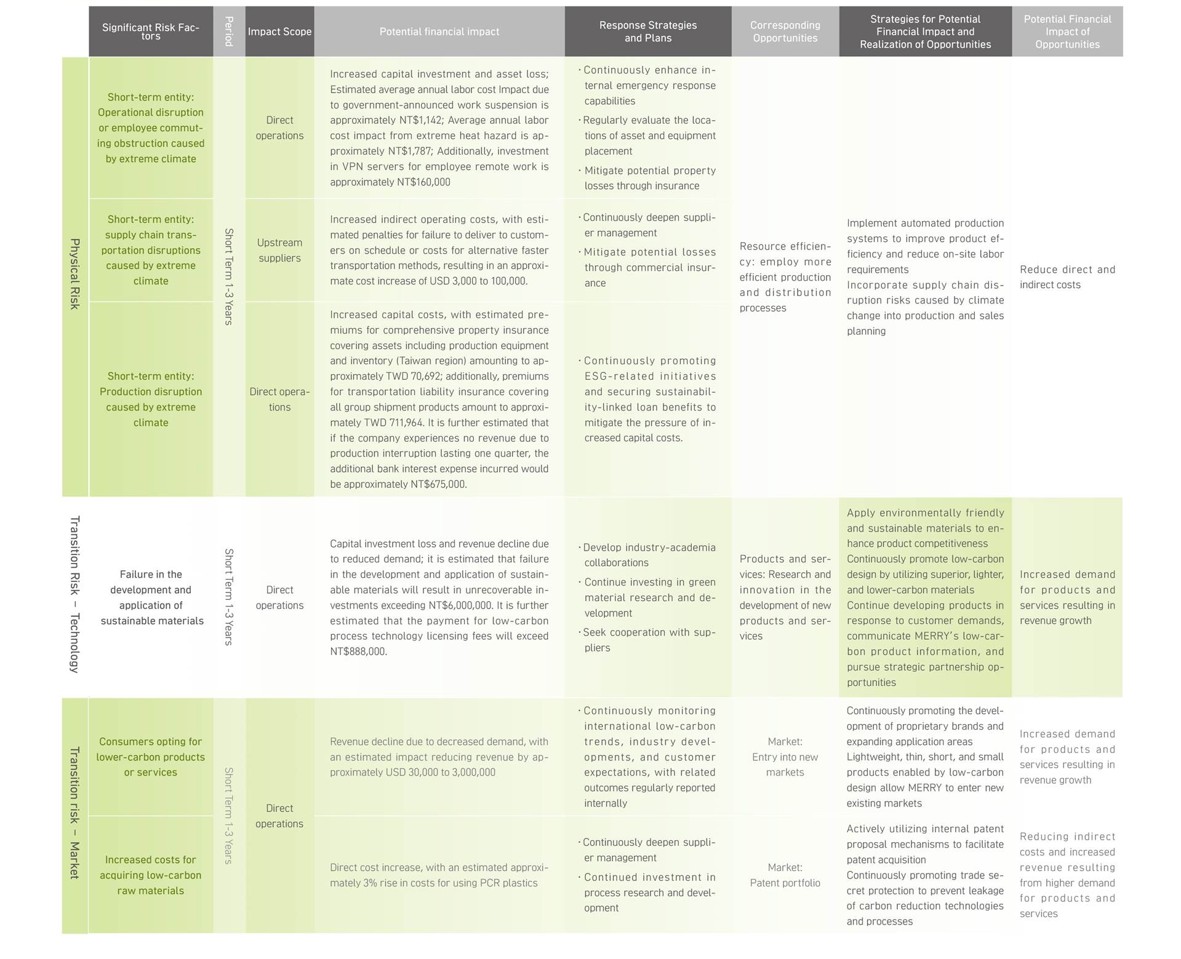

Climate Risks and Opportunities

MERRY based on climate scenarios, risk management mechanisms, indicators, and targets, utilizes a comprehensive governance system to annually assess the transition and physical risks recommended by the TCFD framework, referencing political regulations, economic activities, physical environment, society, technology, and other factors, as well as the impacts on the value chain when affected. In 2024, MECL further advanced the TCFD risk assessment to enhance the intensity and scope of climate risk management, consolidating significant physical and transition risks as detailed in the table below. From 2024 onward, the quantification of risks' potential financial impact will be progressively explored, with mechanisms established for cost or revenue estimation, and these quantified results will be reported to the Sustainability Development and Nomination Committee. Thereafter, the TCFD assessment framework will be progressively introduced at manufacturing sites in Thailand and Vietnam.

Taiwan Headquarters

MECL